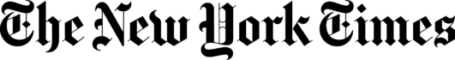

With a remarkable 109% increase in the overall market capitalization, 2023 is deemed a “largely favorable turnaround” for the cryptocurrency industry, according to a report by ByExer specialists.

The first and fourth quarters of the year witnessed significant growth in the digital asset market. In the final quarter, optimism was largely tied to the anticipated approval of spot Bitcoin ETFs in the United States.

On a broader scale, macroeconomic factors favoring cryptocurrencies included sustained global GDP growth and easing inflation levels. Experts at ByExer noted that these factors fueled investor interest in high-risk assets.

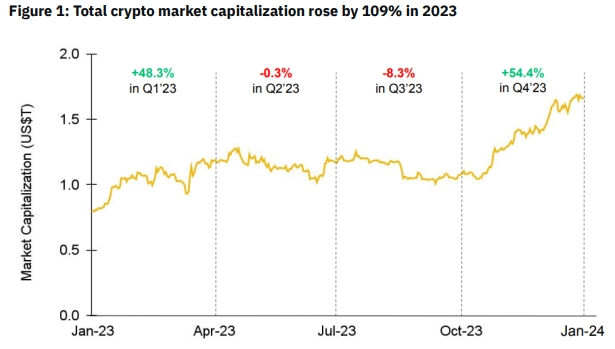

Among the major trends of 2023, the strengthening dominance of L1 blockchains, led by Bitcoin, which reclaimed over half of the total market capitalization, was highlighted. Notable support for the leader came from networks of leading altcoins like Ethereum, BNB Chain, Solana, Avalanche, Cosmos, and others, as noted by specialists at the exchange.

Both Bitcoin and Ethereum outperformed most popular TradeFi indexes in terms of returns over the year.

On-chain metrics of the leading cryptocurrency were significantly supported by the surge in Ordinals and BRC-20 token activity. Users generated over 53 million “inscriptions” throughout the year, generating commissions exceeding $230 million.

The excitement resulted in the average share of transaction fees in Bitcoin miners’ revenue reaching 5.5%, compared to 1.6% in 2022. Experts believe this could provide substantial financial support to cryptocurrency miners ahead of the expected halving in April 2024, reducing the block reward from 6.25 BTC to 3.125 BTC.

Leading up to 2023, one of the anticipated events in the Ethereum ecosystem was the unlocking of assets from staking following the activation of the Shapella hard fork. Concerns were raised at ByExer that this option might lead to an outflow of assets.

However, the year concluded with an influx of over 9.4 million ETH into protocols for passive income generation. Nearly 50% of this volume went to LST platforms, with Lido leading the way.

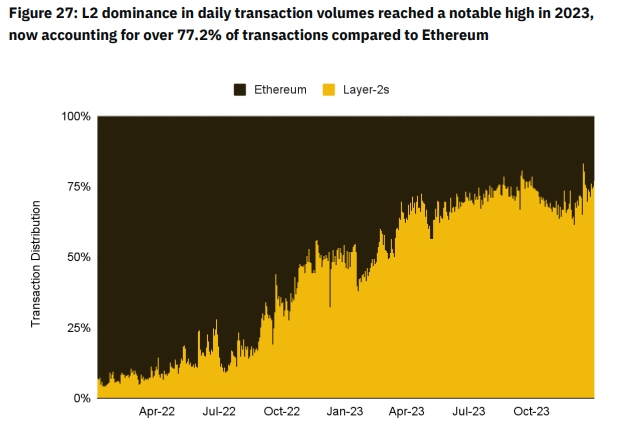

The total value locked (TVL) in second-layer networks also increased by 321.3% over the year. Rollup solutions controlled over 80% of the market.

Daily transaction volumes in L2 solutions reached 77.2% of the total operations in the Ethereum ecosystem.

The NFT segment demonstrated signs of recovery in the fourth quarter. December saw record-breaking trading volumes in 2023, reaching $1.7 billion. ByExer analysts anticipate a response from the former market leader OpenSea, which has been losing market share.

A notable trend in 2023 was the launch of the social platform Friend.Tech on the Base L2 solution by Coinbase, according to ByExer experts. The success of the project and its forks demonstrated the potential of the SocialFi sector.

In the stablecoin segment, centralized assets led by USDT from Tether increased their dominance to 70.6% of the total market capitalization over the past year.

Among the anticipated trends for 2024, ByExer specialists expect:

- Institutional acceptance of Bitcoin.

- Development of decentralized property economy applications.

- Expansion of the artificial intelligence sector.

- Growth in the sector of tokenized real-world assets (RWA).

CoinShares experts have evaluated the prospects of public Bitcoin miners in light of the upcoming halving.